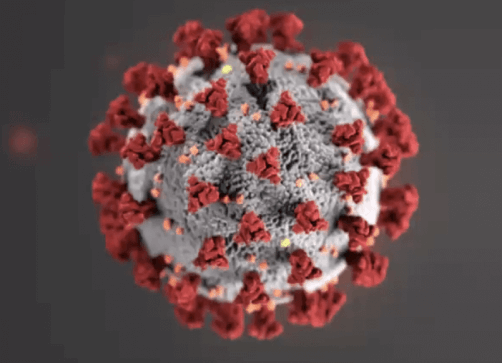

Welcome, 2021! Please just do whatever it takes to do better than 2020, because no one is interested in a repeat of last year. I am filled with hope for this chance to start fresh with endless possibilities. Its promising that COVID-19 vaccines being deployed throughout the country, Delaware’s Joe Biden will be inaugurated in a few weeks and a new General Assembly will start their work next week.

While 2020 was not ideal, and I know Delaware nonprofit organizations are still struggling, I am filled with excitement by what we all managed to do in response to the COVID-19 pandemic. Nonprofits across the state worked to ensure their employees and clients were served. In collaboration with the Delaware Community Foundation, the United Way of Delaware and Philanthropy Delaware, DANA worked with partners at the State of Delaware and New Castle County to direct Coronavirus Relief Funds to nonprofit organizations for their COVID related expenses through the Nonprofit Support Program. These are just a few examples of what we can all achieve as a sector when we work together for the greater good, and I know that we can apply that to our continued efforts in 2021.

On the afternoon of January 12th, we will welcome legislators back for the 151st General Assembly ready to be sworn in virtually. If you’ve not had an opportunity to learn about the new folks in the legislature, please take the time to do so because you’ll find great partners for your organizations.

At the state level, DANA will focus on ensuring the policy environment supports the nonprofit sector. First, we are committed to protecting consistent funding to Grant-in-Aid. DANA remains steadfast on meaningful contract reform for nonprofit agencies and the related proposal to increase minimum wage to $15 per hour by 2026. Our members have shared that though they support their employees paid higher rates, they have concerns over unintended consequences of this measure. Raising wages without a corresponding increase in state grants and contracts could reduce available services. Our members have experienced the difficulty in continuous service on behalf of government with no rate increases for years. It puts pressure to find revenue in other areas or, cut back on other resources needed for sustainability and innovation. DANA is requesting a provision be added to any minimum wage legislation requiring a commensurate increase in in contracts and grants levels. The bill has not yet been introduced but expect something in January.

From the federal perspective, the current Administration and Congress worked feverishly on the Omnibus Appropriations and Emergency Coronavirus Relief Act over the holiday. While you can certainly read the full text, the National Council of Nonprofits created a handy reference chart for Nonprofit Provisions in the COVID Relief Legislation that is pretty amazing. For additional information regarding the revised PPP Program and Shuttered Venue Grants please review the summary provided by Charlie Vincent of Spur Impact (and DANA board member) for greater detail.

A few items of note in the federal legislation:

- Another round of Paycheck Protection Program (PPP) will be made available to both nonprofit and for-profit organization that employ fewer than 300 employees and show a 25% reduction in gross revenue between the same quarters in 2020 and 2019 and expanded eligibility to include qualified 501(c)(6) organizations.

- An extension of the Charitable Giving Incentives through 2021 provides an incentive to taxpayers for the first $300 of charitable contributions. This is the opportunity to encourage donors to take advantage of these giving incentives, and advocate for increasing the above-the-line deduction to a higher amount. As the Small Business Administration provides guidance, we will be sure to share that out to our members.

Finally, it should be noted that the IRS is seeking to make potential revisions to nearly six dozen IRS forms, including the Form 1023 and Form 1023-EZ applications for tax-exempt status and the Form 990 informational tax return and various schedules. They are seeking comments by January 11, 2021. Please take a moment to review the proposed revisions and provide comments here.

As always, Team DANA appreciates the engagement of our members as we move into legislative session! Given the work will be virtual, I hope that provides the opportunity for members to participate. We will again hold our Annual Budget Update Webinar on February 1st; we will have virtual advocacy opportunities throughout Legislative Session.

If you have questions or would like to discuss policy initiatives that will impact our nonprofit sector, please reach out to me at [email protected].